How can I manage my money abroad

There are many different ways to manage your money as you travel and if you aren’t familiar with the language or your destination, it is useful to have a safe method in mind before you travel, so you are free to enjoy! With a range of options available to you, Kaya have put together a short summary of options and our own recommendations, to help you navigate the world of foreign currency.What are my options?

Traditionally, going abroad meant a trip to the travel agent to exchange your money into cash currency. Most people don’t want to exchange all of their spending money all at once though for fear of having it lost or stolen. Additionally, some countries have closed currency, meaning you can’t exchange it in your home country before you arrive.

Exchanging your money on arrival is an option, but airport exchanges nearly always have the least favourable exchange rate. If you do plan to exchange, opt for an authorised dealer in the city.

Many travellers are tempted to simply use their debit/credit card abroad, as it is a fast and easy way to access cash. However the danger is that your bank will charge you a fee per transaction, therefore it is best to take large amounts each time and minimise your withdrawals. Additionally, make sure that your card is internationally accepted, as not all are. For instance you will struggle with Mastercard in Peru. Finally, you must notify your bank before your travel as they will place a ban on your card if they suspect fraudulent activity.

In the past, travellers cheques have been regarded as the safest way to carry money, as they can be replaced if lost or stolen. However, these are much less commonly used abroad now, and in some more remote locations, you may have trouble finding somewhere to accept them.

A safe and more popular alternative to travellers cheques, is a pre-paid currency card, which helps you keep a tab on your spending. You load the card with your desired amount before departure, online or using the phone, and can use the card as you would your debit card, to pay with or withdraw money. The difference is, aside from the preferable exchange rates and ATM charges, if the card is lost, stolen, or subject to fraud, you can contact the issuer and have one reissued straight away; plus your money is insured. It can also be topped up online from anywhere in the world.

There are a lot of options for currency cards. At Kaya we recommend Caxton FX currency cards as a good and safe option, with a competitive rate and an easy top-up system. You are under no obligation to use this method.

The safer, smarter way to pay abroad

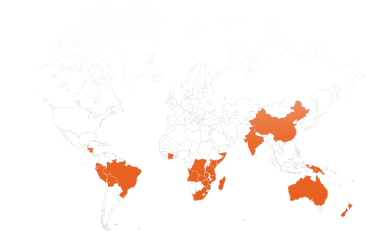

Caxton FX Visa currency cards help thousands of travellers exchange currency at a competitive rate, provide a safe way to carry currency overseas and make it easy to exchange and access travel money – at home or abroad. ·

- Great exchange rates ·

- Load online, over the phone by SMS or with the app ·

- Free* to use in restaurants, shops, hotels and other outlets worldwide ·

- UK customer support team

Visit this link to get your card.

It will arrive in the post within five days.

*Caxton FX does not charge a fee for international point of sale or international ATM transactions. However, some merchants or ATMs may do.